Summary

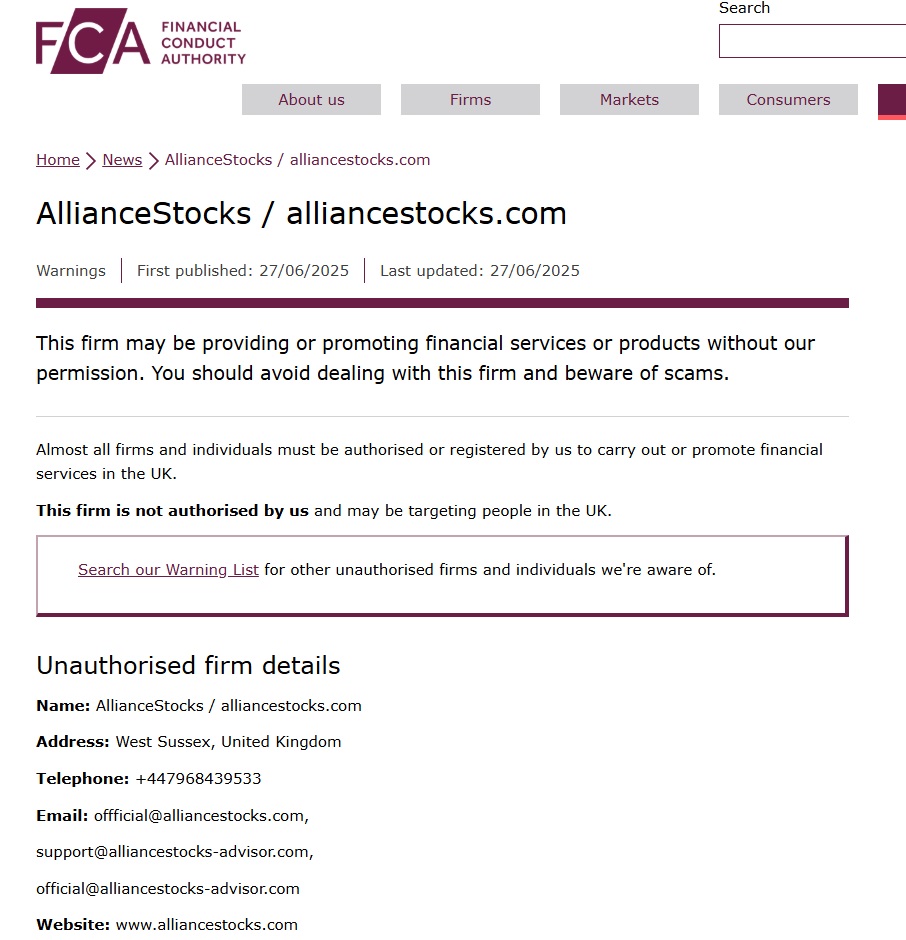

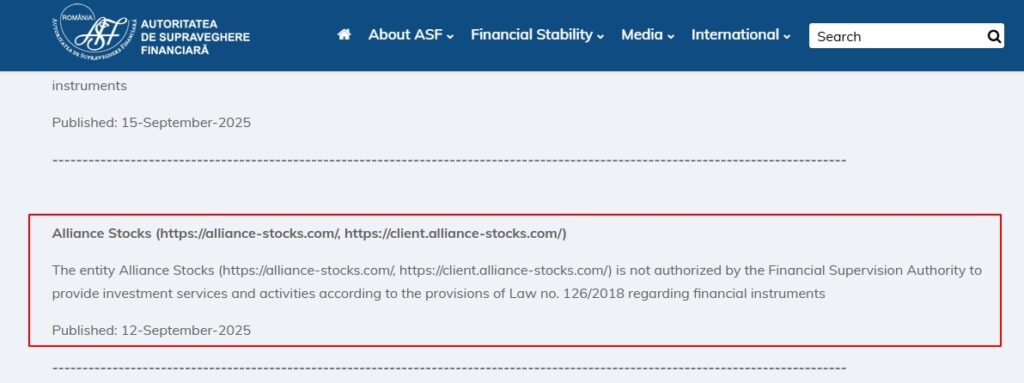

Several major regulators have warned Alliance Stocks to be a suspicious broker, with the UK’s FCA and Romania’s Financial Supervisory Authority being among them. It lacks any regulatory oversight, gives misleading contact details, and other dangers can be seen. Additionally, Alliance Stocks traders are not protected by the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS), which could lead to greater losses. Allegations of involvement in fraudulent activities have also been made against Alliance Stocks, among which is ‘Alliance Limited’, which promises a risk-free return on investment via crypto. In conclusion, there are very strong red flags for Alliance Stocks, and thus, it is a very high-risk and unreliable platform for any investing purposes.

Alliance Stocks Overview

Company Name: Alliance Stocks

Website: https://alliance-stocks.com/

Address: West Sussex, United Kingdom

Regulation Status: Unregulated

Operating Since: 2025-04-03

Warned By: Financial Conduct Authority (United Kingdom) and Romania’s Financial Supervisory Authority

Observations That May Require Caution

Many factors of Alliance Stocks’s activities have shown red flags from user feedback that should caution us. Check the things that you should consider:

- Regulatory Status: Verify that Alliance Stocks has a valid license from an official financial regulator. This means that you have less protection as an investor because the platform is unregulated.

- Withdrawal Feedback: User complaints regarding withdrawals being declined, withdrawals taking too long, and/or being unclear about terms for getting your money back could all be warning signs.

- Ownership Transparency: If Alliance Stocks does not disclose their management team, or their physical office(s) location, or their parent company, it will be difficult for you to hold anybody accountable.

- Fee Structure: Ensure Alliance Stocks clearly states all fees, including spreads, withdrawal charges, inactivity penalties, and commissions. Unexplained or hidden fees may affect your returns.

Alliance-stocks.com may exhibit some or all of these concerns, which is why careful evaluation is strongly recommended.

Why Regulatory Status Matters?

What Regulation Means for Traders?

Regulation is carried out by authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus), which have regulations about dispute resolution, fund protection, and transparency.

What to Consider with Unregulated Brokers?

If a broker has no obvious oversight:

- Dispute resolution can be difficult if there are problems.

- There is no formal obligation for client funds to be segregated.

- The broker can change terms or accounts with no notice.

For this reason, assessing a platform’s license before paying over funds is widely recognised as common and responsible practice.

Platform and Investment Conditions

Alliance Stocks may offer services that would appear appealing – tight spreads, crypto staking, etc., but among the user feedback we have collected, there are areas where further clarification would be beneficial.

Transparency Around Services

The broker may have a lack of detail in the available documentation. Typically, you would expect to see terms and conditions of service, trading policies, and staking rules (if offered) to be visible.

Transaction Fees and Costs

Users have mentioned unclear or unprovoked fees, especially related to withdrawal or maintenance of an account. Fees are a common practice in trading and should always be given beforehand explicitly.

Platform Stability

While reviewing user feedback, there is mention of variability in platform stability, including occasional problems logging into an account or delays in executions. These have the potential to disrupt the trading experience and should

Check the updated list of scam brokers for similar cases

Understanding the Nature of Potential Risks

Forex Trading Concerns

Unregulated forex platforms may promise high leverage or unrealistic returns. With no regulation, price manipulation and spread widening, particularly during times of high volatility, cannot be ruled out.

Crypto Services

If a platform is providing staking or a crypto-related service, it is worth reviewing the structure.

Unverified Bonus Schemes

Some trading platforms will also offer a bonus or promotional funds with buried terms, such as minimum trade volumes before being able to withdraw funds. It can be hard to access your funds later on, and therefore, it is always best to read the fine print.

FAQs

Q: Is Alliance Stocks a licensed or regulated broker?

A: It doesn’t seem like any publicly available information suggests that Alliance Stocks has a license from any significant financial authorities.

Q: Can I withdraw my funds easily from Alliance Stocks?

A: There have been some complaints from consumers about difficulties with withdrawals. It’s important to read user reviews and study the platform’s withdrawal policy.

Q: What makes a broker a scam?

A: Common indicators include unregulated status, false promises of returns, withdrawal denial, lack of transparency, and aggressive sales tactics.

Final Words

Although Alliance Stocks may provide a variety of financial services, user-reported concerns and a lack of regulatory transparency indicate that potential investors should do extensive research before committing. You might be able to make a better choice if you compare it to brokers who are subject to regulations.

If you believe you’ve been affected by Alliance-stocks.com, feel free to contact us or report a scam through our platform to help others stay informed.

Stay informed. Read broker reviews, compare platforms, and always verify licensing details. For more insights, visit BrokersReviewer.com.

For more updates, follow us on:

Leave a Reply